COSME Tokyo 2026: What Beauty Founders Should Actually Pay Attention To

COSME Tokyo 2026 is one of the clearest early indicators of where beauty is heading next. MSLK was on the floor, walking booths, talking to vendors, and tracking what repeated across categories. The scale alone signals why it matters. More than 700 exhibitors and more than 30,000 visitors filled Tokyo Big Sight over three days, with constant business conversations across the venue.

What we saw points to a shift in how products are being developed and how brands are expected to communicate. Innovation is accelerating, especially in biology-led skincare, but success still depends on clarity, safety, and trust. Here’s what stood out and why it’s worth noting.

Skincare and Haircare Is Moving from Chemistry to Biology

For years, skincare and haircare education revolved around chemistry. Consumers learned acids, percentages, and ingredient lists. That era is giving way to something deeper.

Across the show floor, the language shifted toward biology. Booths focused on cellular signaling, regeneration, expression, and internal systems. Products were framed less as surface-level solutions and more as interventions into how skin behaves over time.

Skincare is being repositioned as something to optimize at the biological level, so the visible results feel like they come from the inside out.

This direction signals a meaningful evolution in product development. Biology offers powerful potential, but it also raises the bar for communication.

The challenge:

• Complex mechanisms do not automatically translate into desire or trust

• Dense explanations slow conversion

• Advanced biology needs to become clear, visible outcomes

The brands that succeed will be the ones that turn advanced biology into outcomes people can immediately understand.

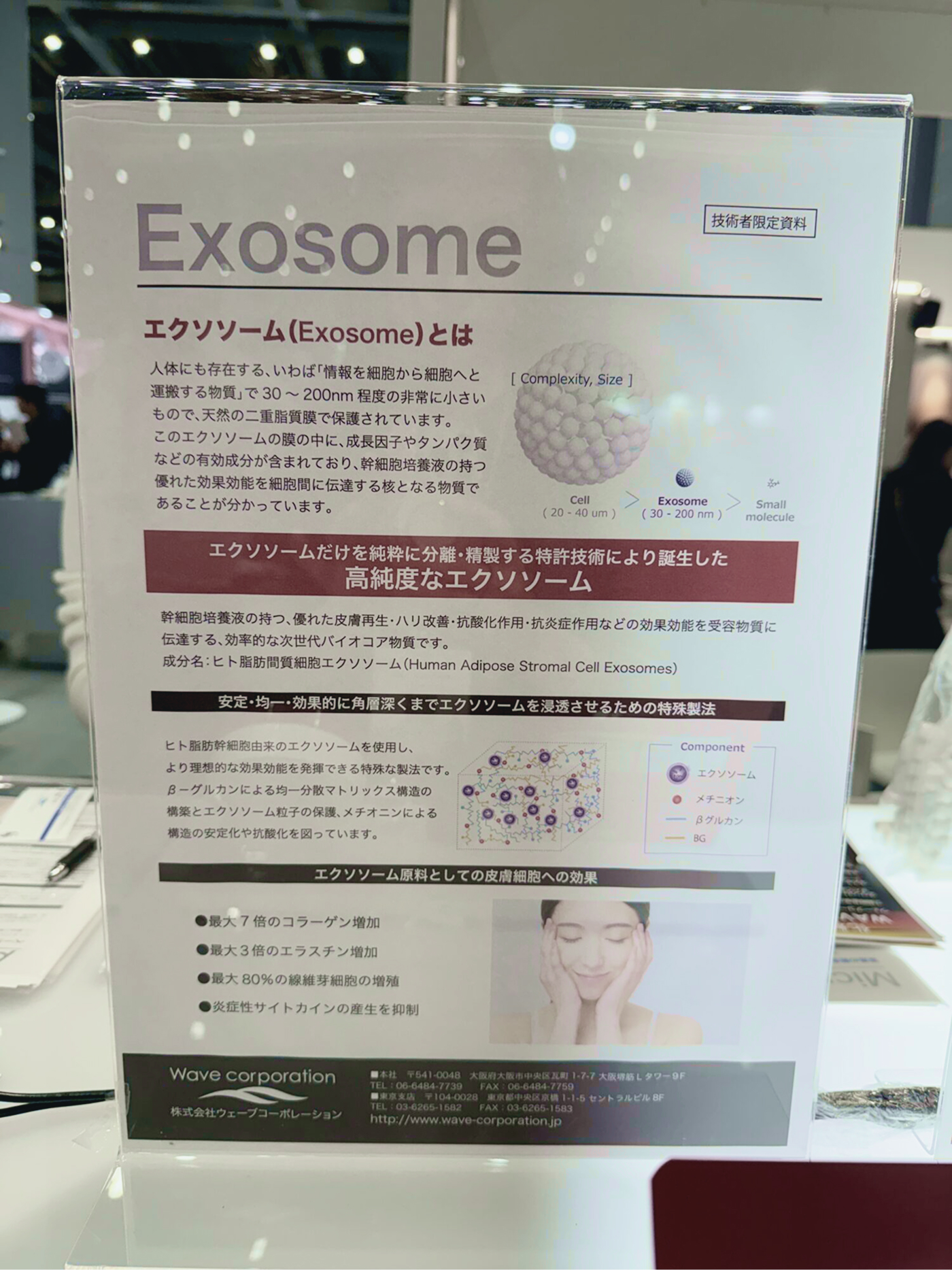

Exosomes Were Everywhere

The most dominant signal at COSME Tokyo was exosomes. The number of exhibitors showcasing them was impossible to miss. They showed up everywhere, from skincare serums and masks to scalp treatments and hair care, often positioned as the next step in visible skin quality and renewal.

That level of momentum matters, and it comes with real constraints. Exosomes sit in a tightly regulated area, and the FDA maintains a clear stance on how they can be marketed. Claims that imply the following move a product out of cosmetic territory and into enforcement territory:

• Tissue repair

• Regeneration

• Collagen stimulation

• Healing

In practice, a single verb can create risk.

Discipline Over Novelty:

The winning approach is discipline. Exosomes work best when positioned as part of a broader formulation story, paired with known actives, and framed around appearance-based benefits. Safety, sourcing, and language do more heavy lifting here than novelty. Brands that treat exosomes as the headline without guardrails create exposure instead of advantage.

In the wake of the exosome wave, DNA-led ingredients like PDRN are also accelerating, often tied to marine sourcing and clinic-adjacent credibility. These narratives can break through crowded categories, but they still require the same discipline.

Keep the story in the mirror, not the microscope. Lead with the visible change and the use case. Let the science sit underneath as proof, not as the pitch.

When Ingredients Become the Brand

Exosomes did not stand alone. They were the clearest example of a broader shift toward ingredient-first positioning.

As biology-led innovation accelerates, ingredients are increasingly treated as the headline, with finished products acting as delivery systems rather than the main story. Across categories, the same ingredient names and acronyms appeared repeatedly across unrelated brands.

The Double Edge of Ingredient-Led Positioning

This approach creates:

• Instant differentiation on a crowded floor

• Complex science compressed into a single hook that feels proprietary and future-facing.

The limitation is scale. Ingredients only carry weight once people recognize them. Without sustained education, ingredient-led positioning quickly collapses into shorthand comparisons and price pressure. What feels distinctive in a trade show environment can become interchangeable once it reaches the shelf.

Authority and Playfulness Are Pulling Design in Opposite Directions

Aesthetic direction across the show was polarized. Brands leaned heavily toward two ends of the spectrum. On one side, hyper-clinical design emphasized authority, data, and medical cues. On the other, playful and character-driven visuals emphasized joy, softness, and accessibility.

Visual Language Sets Expectations Instantly

What matters here is signal, not inspiration. These visual extremes are likely to show up more in upcoming launches, especially in:

• Biology-led skincare

• Ingredient-forward hair care

As those products enter the market, consumers will be trained to look for cues of proof and cues of safety at a glance. Clinical design does that through authority. Playful design does it through approachability.

This matters because visual language sets expectations instantly. Before someone reads ingredients or claims, packaging tells them whether a product feels medical, gentle, premium, or fun. That first impression is becoming part of the performance story.

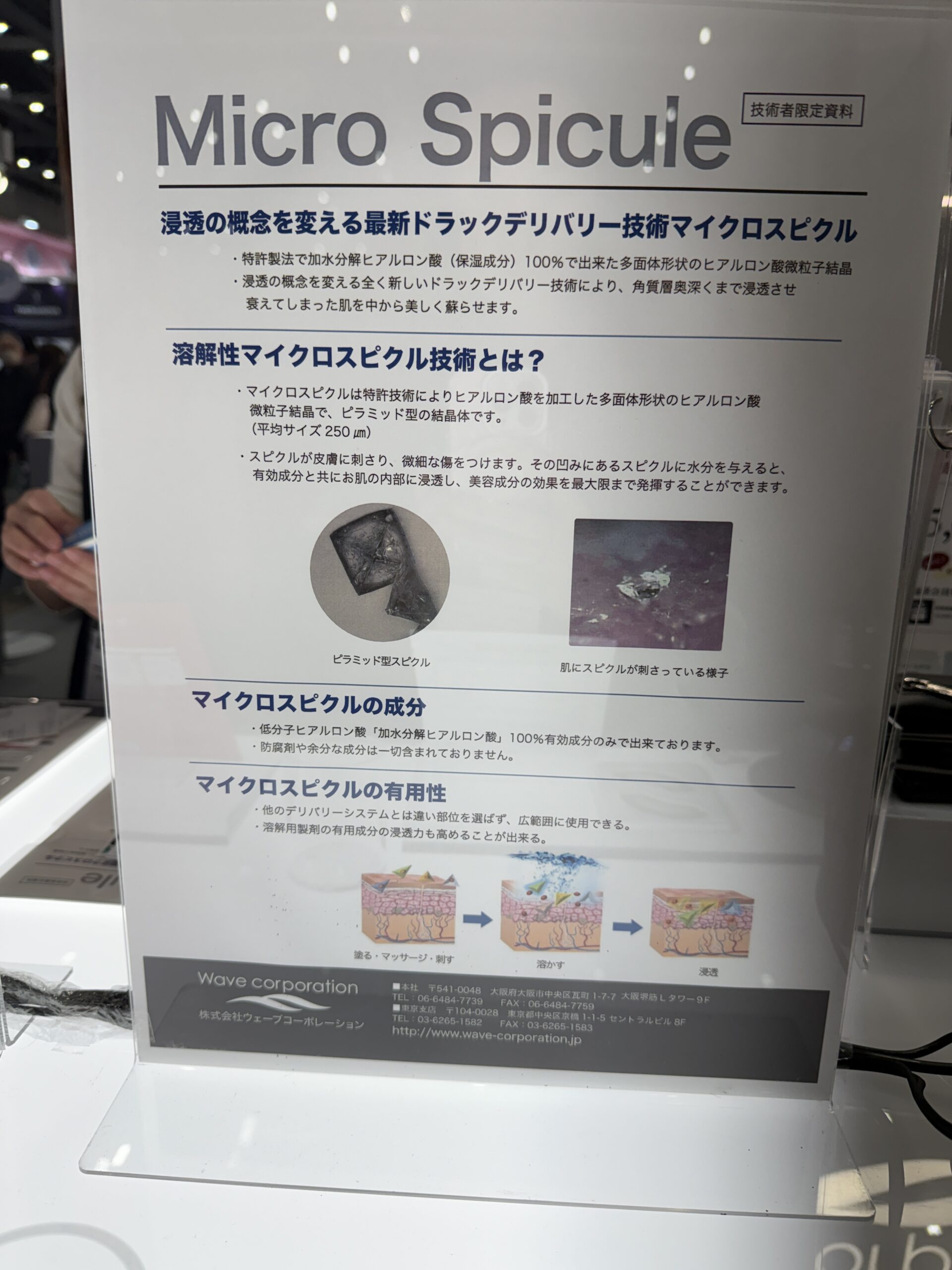

Packaging That Explains Itself

While ingredient-led science dominated the floor, many of the most usable breakthroughs showed up in format and packaging. Instead of introducing unfamiliar routines, brands applied known behaviors to new problems, removing the need for explanation.

Format as Teacher

Clear examples appeared across categories:

• A “BB cream for nails” reframed nail treatment using a concept people already understand from makeup

• Dissolvable strips borrowed from breath fresheners turned ingestible beauty into a familiar, low-friction habit

In both cases, the format did the teaching before any claims were made.

Packaging played a similar role. Matte, grippy finishes made products feel like tools rather than decorative objects. Weighted caps were used to signal formula stability and value. No-touch spatulas and airless pumps emphasized hygiene and potency, while dispensing systems quietly guided usage without relying on instructions.

When behavior feels familiar, adoption accelerates. Innovation that fits into existing routines moves faster than innovation that asks people to learn new ones.

What These Signals Mean for Beauty Leaders Now

The patterns coming out of COSME point to where pressure is building across the category. Biology-led innovation is accelerating. Regulatory constraints are shaping how far certain claims can go. Ingredients are doing more of the positioning work, while format, packaging, and language are carrying more of the trust.

For established brands and business owners, this is less about chasing trends and more about understanding how these shifts intersect with what you are already building. Product decisions, claims, packaging, and go-to-market strategy are becoming more connected, and small choices now have larger downstream effects.

If you are thinking through how any of this shows up in your own roadmap, whether it affects formulation, positioning, or how your products are presented, we are always open to talking it through. Sometimes it helps to pressure-test what these signals mean in practice, not in theory.