COSME Tokyo 2026: Translating Beauty Between East and West

To walk the floor of COSME Tokyo 2026 is to witness the incredible energy of the global beauty industry. With over 30,000 attendees and 700 vendors, the event feels like a laboratory for the future. For many, it is a sensory experience filled with new textures and bold displays. But for a brand strategist, it reveals how the global beauty economy is shifting.

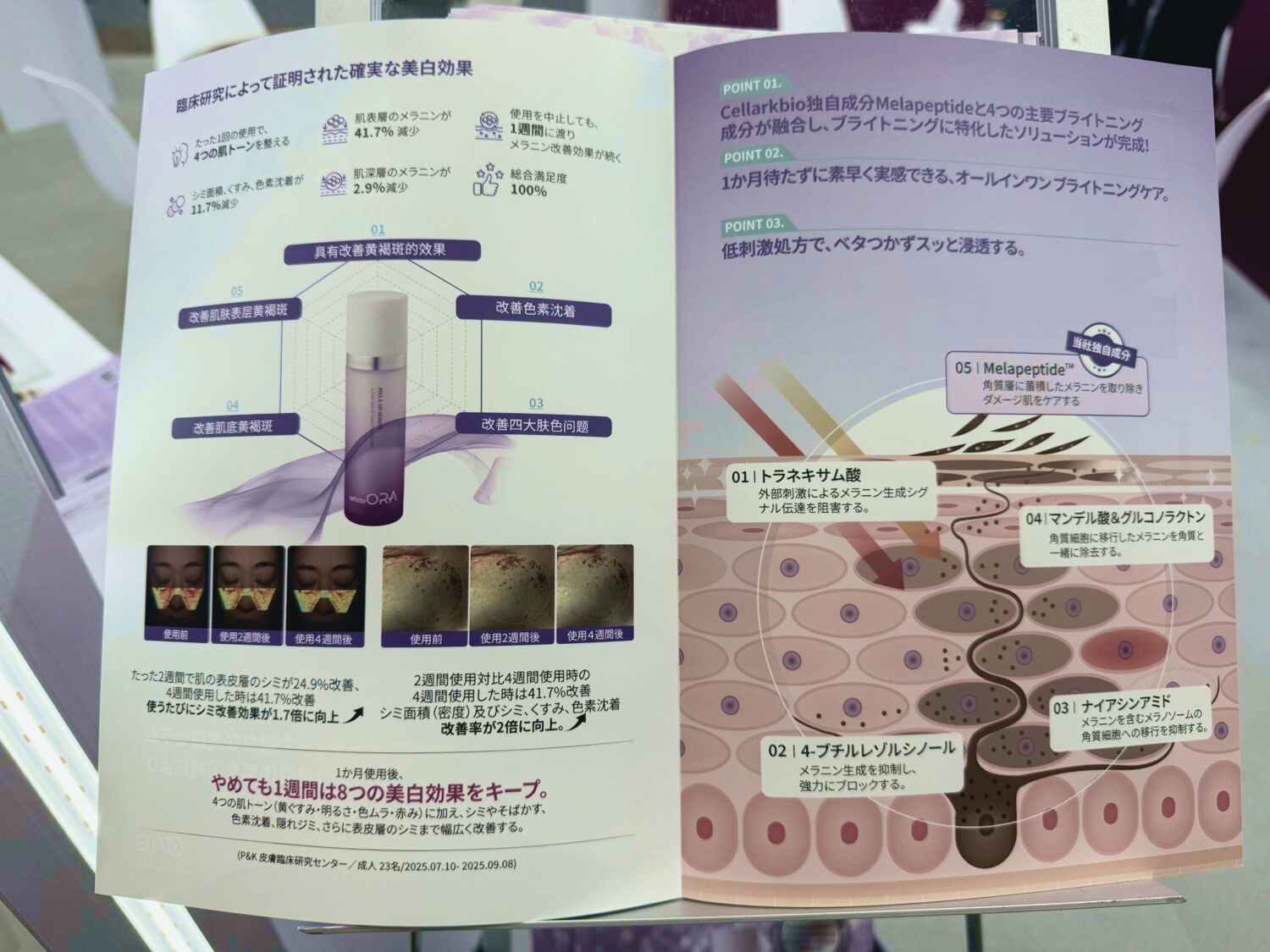

We are seeing a clear difference in how markets approach the concept of “care”. In Japan and Korea, brands are focusing on “High-Science” innovations like biology and cellular health. Meanwhile, the US market is moving toward “High-Clarity” and “High-Safety”. The American consumer, often overwhelmed by digital information, is looking for simple, honest proof that a product works.

The challenge for brand leaders is how to translate these complex ideas for a consumer that expects immediate results. This is about more than changing words on a box; it is about changing how we communicate the value of a product.

The Shift from Chemistry to Biology

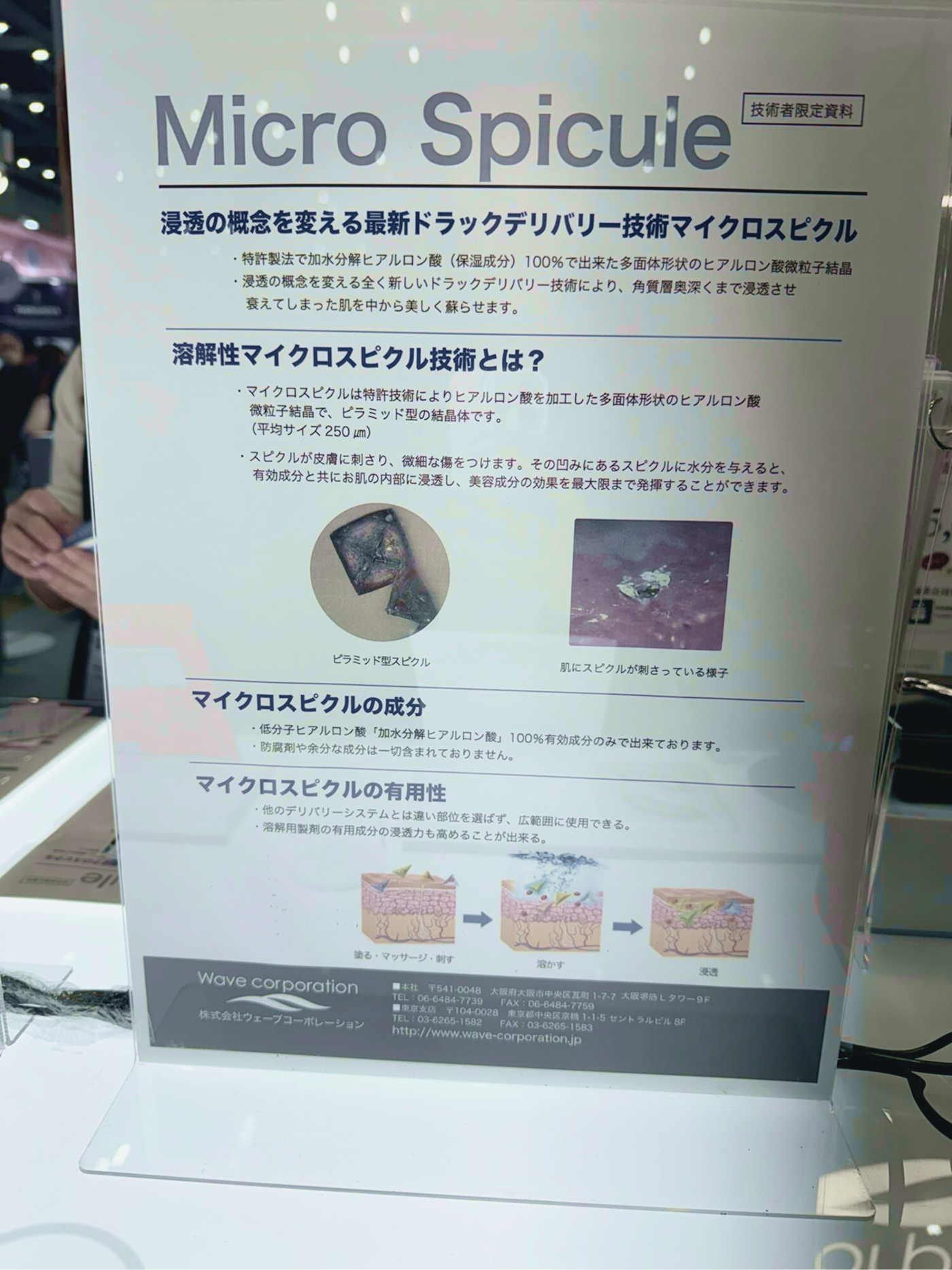

A recurring theme we saw was a move away from chemistry-led language toward biology-led thinking. Instead of focusing on acids, exfoliation, or surface correction, many brands spoke about cellular communication, signaling, and skin function.

Products were positioned as supporting the skin’s internal balance rather than reacting to visible problems. The message was subtle but consistent: skin is not just something to fix, but something to maintain.

At COSME Tokyo, this idea was often communicated through detailed scientific explanations. On the floor, depth and complexity acted as signals of credibility.

What This Means in the US Beauty Market

US consumers are ready for biology—but they want it to feel usable, not academic. They respond when science is connected to a daily concern and explained in one breath.

The most effective translation is to shift from “how it works” to “what you will notice”:

• How does your skin feel after two weeks?

• What changes in texture, tone, or comfort?

• What problem does this prevent from coming back?

Then reinforce trust with clarity: safety, testing, and a benefit-first routine role.

In the US, biology becomes a differentiator only after clarity becomes the baseline.

The Visual Language of Authority

Visually, brands communicated with strong intention. Many leaned toward clinical expressions—structured layouts, minimal color, medical cues—while others embraced softness and approachability through playful forms and gentle palettes.

What stood out was decisiveness. Each brand clearly signaled how it wanted to be understood.

Design was not decorative. It functioned as instruction, helping visitors quickly understand whether a product was precise, gentle, advanced, or comforting.

What This Means in the US Beauty Market

US consumers read packaging like a verdict: Is this credible? Is this safe? Is this for me? Visuals answer that faster than copy.

For the US market, the goal is not to choose between “clinical” or “playful.” It is to design a third lane:

• Clinical signals that say “this works”

• Editorial warmth that says “I can trust this”

That means simplifying the system the consumer sees:

• One hero message per panel

• One clear product role

• A look that feels premium and calm instead of severe or childish

The beauty brand wins when the design reduces doubt.

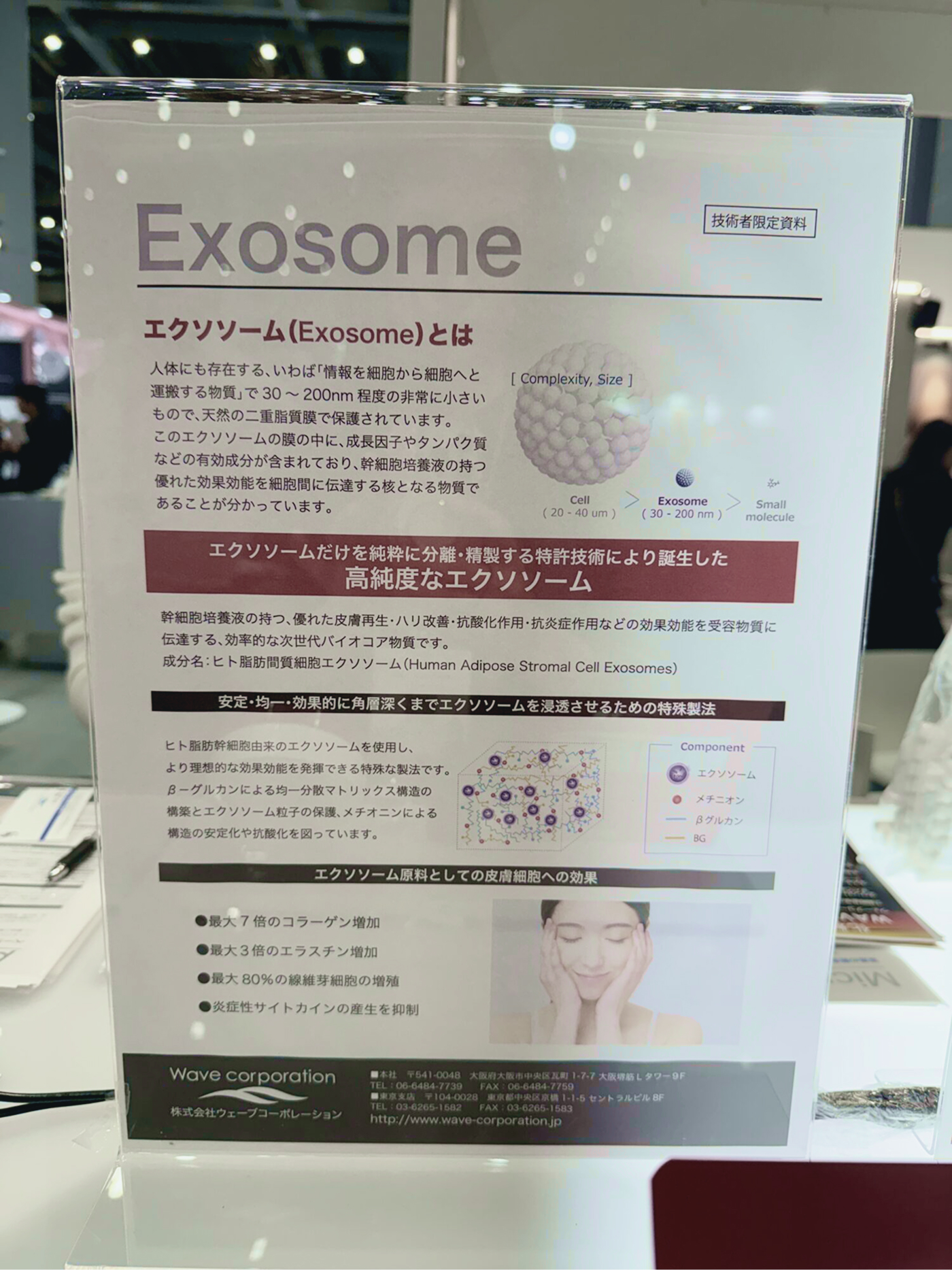

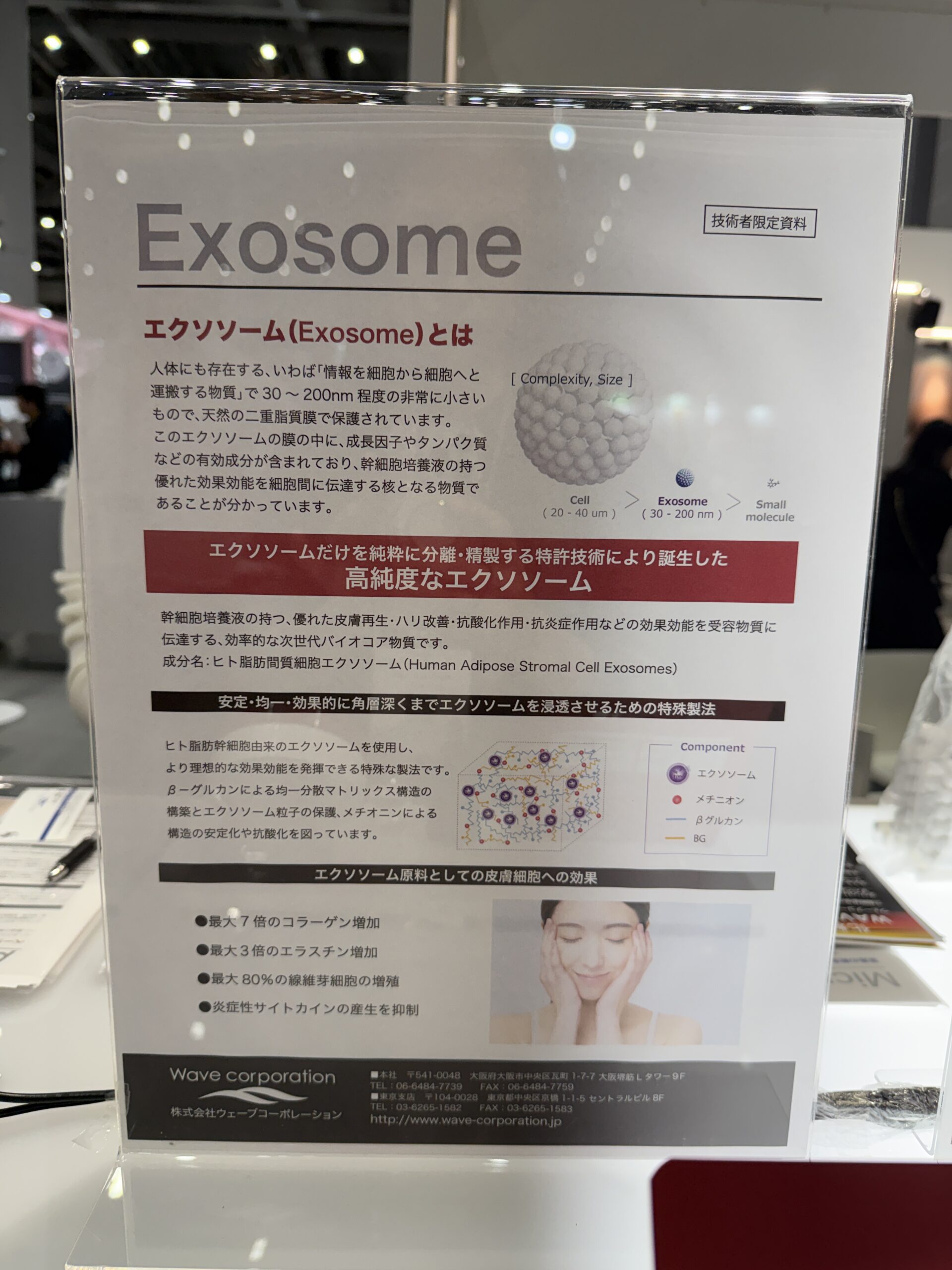

Exosomes on the Show Floor

Exosomes appeared across many, many categories. They were presented as part of advanced formulations designed to support visible skin quality and overall appearance.

Rather than being framed as standalone solutions, exosomes were often integrated into broader systems. Their role was explained as supportive—working alongside other ingredients to enhance the overall formula.

The assumption on the show floor was familiarity. Explanations were technical, and the focus was on how exosomes function within the skin environment.

What This Means in the US Beauty Market

In the US, exosomes immediately raise a different set of questions. Interest is strong, but so is attention to regulation—particularly when new technologies intersect with biological language.

While the regulatory landscape continues to evolve, US consumers and retailers are highly attuned to signals of compliance, safety, and oversight. The presence of the FDA as a governing authority shapes how emerging ingredients are interpreted, even before specific rules are clearly understood by the public.

For brands introducing exosome-based concepts in the US, this means:

• Staying firmly within appearance-based language

• Communicating safety, sourcing, and formulation standards with clarity

• Positioning exosomes as part of a complete, well-balanced formula

In the US market, trust is built not through bold claims, but through restraint and transparency, especially when innovation moves ahead of regulation.

Ingredient Identity and Signature Actives

Another pattern we saw was the emphasis on ingredient identity. Many brands highlighted a specific active or complex as a signature element used across multiple products.

This approach creates consistency. It allows brands to build recognition around a shared foundation rather than individual launches.

On the floor, ingredient stories were often supported by sourcing details and development narratives, reinforcing credibility through transparency.

What This Means in the US Beauty Market

In the US, ingredient familiarity plays a major role in trust. Consumers are more receptive when new actives are connected to known concerns and explained in simple terms.

Ingredient-led strategies work best when:

• The benefit is immediately clear

• Education is introduced gradually

• Messaging stays consistent across products

Recognition is built over time, not in a single launch.

Communication and Interpretation

How Products Explain Themselves on the Show Floor

At COSME Tokyo 2026, many brands communicated value through a mix of cues: ingredient naming, scientific language, packaging design, and how the product was demonstrated in-person. On the floor, these cues worked together. You could see the intended use, the level of sophistication, and the product philosophy—often without long explanations.

What we observed is that the same cues can be received differently when a product is introduced in the US. Not because the concept is weaker, but because US consumers often decide faster and expect the product to explain itself more directly at first glance.

This creates a simple planning question for brand leaders: Which parts of your story are best shown, and which parts need to be stated clearly in US-facing communication?

What This Means in the US Beauty Market

In the US, messaging tends to perform best when it starts with:

• The core benefit (what it helps with)

• The product role (where it fits in a routine)

• A clear reason to trust it (testing, standards, or expertise)

Once that foundation is in place, deeper stories—science, heritage, process—land with more impact, because the consumer already understands what the product is for.

Ingredient Origin and Trust Signals

Where Ingredients Come From as Part of the Story

Another theme we saw repeatedly at COSME Tokyo was a focus on ingredient origin and process. Many exhibitors emphasized where a material was sourced, how it was handled, and what makes it distinct—often using visuals, maps, or short explanations to reinforce credibility.

This did not feel like decoration. It was presented as part of quality: ingredient origin as a trust signal, and process as evidence of care.

What This Means in the US Beauty Market

In the US, ingredient origin can be a strong trust builder—especially when it is shared in a clear, grounded way.

The approach that translates best is simple:

• State the source

• Explain what that source contributes (purity, stability, quality)

• Connect it to a visible benefit or performance outcome

This helps US consumers understand that the product is not only “interesting,” but also dependable.

Closing Thoughts

A week after COSME Tokyo 2026, what stays with us is the intention. The show floor reflected a beauty industry investing in precision: science that go es deeper, routines designed for consistency, and products built to earn trust through process.

For US market entry, the next step is communication. American consumers need a clear reason to start and a clear reason to stay. They want to understand what a product changes in their everyday life—and they look for confidence cues around safety, language, and expectations.

If you’re preparing to bring innovation into the US market, we’ve created a resource to support that translation: The American Skincare Playbook: A Guide for International Brands Entering the American Market.

It covers the practical realities that shape success in the US: from FDA-sensitive wording, to “clean” baseline expectations, to positioning that earns trust with American consumers.